Clear communication and detailed documentation are essential for expediting insurance decisions in auto body insurance coverage. Straightforward language and comprehensive reports on needed car paint services, such as paintless dent repair techniques, streamline processes, save time and money, and build trust among insurers, policyholders, and repair shops. Proper documentation ensures accurate decision-making, reduces errors, and minimizes delays, fostering a responsive and customer-centric insurance environment for auto body repairs.

Proper documentation is key to expediting insurance decisions, especially in auto body repair claims. When policyholders provide clear, detailed records of incidents and damage, it sets a foundation for efficient processing. Clear communication reduces misunderstandings between insureds and insurers, ensuring everyone works with the same information. This streamlined process saves time and resources, while enhanced accuracy leads to faster claims resolution, ultimately benefiting both parties involved in auto body insurance coverage.

- Clear Communication Reduces Misunderstandings

- Streamlined Process Saves Time and Resources

- Enhanced Accuracy Leads to Faster Claims Resolution

Clear Communication Reduces Misunderstandings

Clear communication is a cornerstone when it comes to expediting insurance decisions, especially in the realm of auto body insurance coverage. When all parties involved—insured individuals, insurance adjusters, and repair facilities—use straightforward language and provide detailed documentation, misunderstandings are significantly reduced. This clarity ensures that everyone is on the same page regarding the extent of damage, the necessary repairs, and the associated costs.

For instance, when an individual seeks auto collision center services for their damaged vehicle, a comprehensive report outlining the extent of the car paint services needed can greatly streamline the process. Paintless dent repair techniques, for example, can be documented to demonstrate their suitability for specific types of damage, thereby avoiding confusion and potentially saving time and money. Such documentation not only facilitates quicker decisions but also fosters trust between insurers, policyholders, and repair shops.

Streamlined Process Saves Time and Resources

Proper documentation plays a pivotal role in streamlining the insurance claims process for auto body insurance coverage. When claims are well-documented, from the initial report of damage to detailed descriptions of repairs and costs, it significantly speeds up decision-making. Insurers can quickly assess the validity and extent of the claim, reducing unnecessary back-and-forth communication with policyholders.

This streamlined process not only saves time but also resources for both the insurance companies and their policyholders. For instance, clear documentation in advance eliminates the need for multiple site visits or repeated requests for information, ensuring a smoother experience for everyone involved. Even specialized services like Mercedes Benz repair or auto painting can benefit from this efficiency, as accurate records facilitate faster approvals and payments, fostering a more responsive and customer-centric insurance environment.

Enhanced Accuracy Leads to Faster Claims Resolution

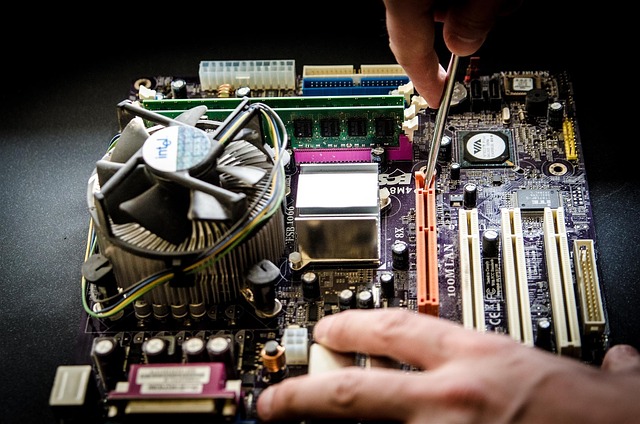

Proper documentation plays a pivotal role in expediting the claims resolution process for insurance companies. When claims are supported by accurate and comprehensive records, it significantly reduces errors and miscommunications that often delay settlements. For instance, in auto body insurance coverage, detailed documentation of vehicle specifications, repair processes, and materials used ensures that every aspect of a car body repair is accounted for, leading to swifter decision-making.

This meticulous approach, which includes comprehensive records on mercedes benz repair or any other vehicle repair services, allows insurers to verify the necessity and extent of repairs much more efficiently. By minimizing doubts and ambiguities, claims can be settled in a timely manner, providing both insurance providers and policyholders with a seamless experience.

Proper documentation is a key component in expediting insurance decisions, especially for auto body repairs. By fostering clear communication between policyholders, insurers, and repair shops, reducing misunderstandings, and streamlining processes, accurate and efficient claims resolution becomes achievable. This, in turn, benefits everyone involved—policyholders get their vehicles repaired faster, insurers reduce administrative burdens, and repair shops enjoy quicker turnaround times. Ultimately, this streamlined approach ensures that auto body insurance coverage is handled swiftly, ensuring peace of mind for all parties.