Many customers find auto body insurance coverage confusing due to complex policy terms, deductibles, and limits. Jargon and varying pricing structures from providers make understanding reimbursement after accidents difficult. Simplifying language and improving transparency is crucial for accurate claims processing without unnecessary stress. Insurance companies should offer clear explanations of coverages and transparent communication throughout the claims process.

Many customers find themselves confused when it comes to understanding and claiming auto body insurance reimbursement. This is largely due to the complexity of auto body insurance coverage and the often-vague reimbursement policies. This article, “Why Customers Are Confused About Claim Reimbursement”, breaks down these complexities. We’ll explore common points of confusion, provide insights into deciphering reimbursement policies, and offer practical tips for navigating claims to ensure a smoother process for both insurers and policyholders.

- Auto Body Insurance Coverage: Unpacking Complexities for Customers

- Deciphering Reimbursement Policies: Why Clarity Eludes Many

- Navigating Claims: Addressing Customer Confusion Points

Auto Body Insurance Coverage: Unpacking Complexities for Customers

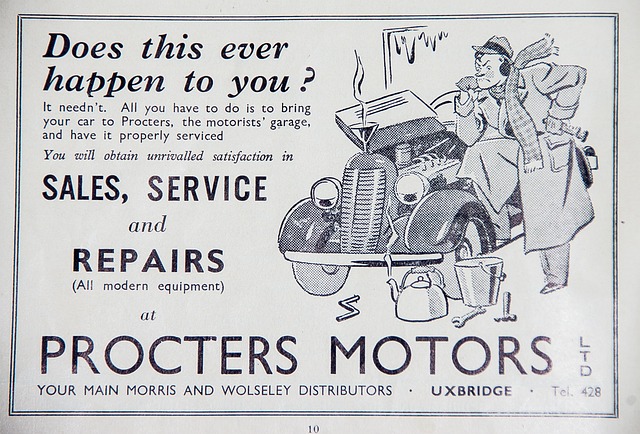

Many customers find themselves confused when it comes to understanding their auto body insurance coverage. This is largely due to the complexities involved in vehicle collision repair and the various components that contribute to reimbursement. Auto body insurance coverage, while designed to protect against financial burden during accidents, can be a minefield for the average consumer.

The process of claiming for autobody repairs, whether for personal vehicles or fleet repair services, requires navigating through layers of policy terms, deductibles, and coverage limits. Customers often struggle to differentiate between what is covered under their comprehensive or collision insurance and what might be excluded. Further complicating matters is the potential involvement of different service providers, each with their own pricing structures. Simplifying this experience is essential to ensure customers receive accurate reimbursement for their autobody repairs without unnecessary stress.

Deciphering Reimbursement Policies: Why Clarity Eludes Many

Many customers find themselves confused about claim reimbursements due to the intricate nature of auto body insurance coverage. Policies often lack clear, concise language when outlining reimbursement processes for various types of vehicle damage repairs, including car damage repair and collision repair shop services. The jargon used in these policies can be a significant barrier to understanding, leaving folks wondering how their specific auto body insurance coverage translates into real-world benefits after an accident.

For instance, while comprehensive auto body insurance coverage promises peace of mind, the fine print might reveal stringent deductibles or limitations on certain types of vehicle dent repair. Customers may also struggle to reconcile pre-existing damage or market value considerations when filing claims for collision repair shop services. This lack of clarity often results in confusion and hesitation when it comes time to file a claim, making it crucial for both insurers and policyholders to strive for transparency in reimbursement policies.

Navigating Claims: Addressing Customer Confusion Points

Navigating claims can be a confusing process for customers, especially when it comes to understanding their auto body insurance coverage. Many policyholders are unsure about what is covered and what steps to take after a vehicle collision repair or even a minor car scratch repair. This confusion often arises from complex terminology and varying policies offered by different insurance providers.

To clarify these points, insurance companies should provide straightforward explanations of their coverages. Customers should be educated on the types of damages that auto body insurance typically covers, such as repairs for collisions, theft, vandalism, or natural disasters. Additionally, offering transparent communication throughout the claims process, including timely updates and clear guidelines for submitting auto repair services or car scratch repair estimates, can help dispel customer confusion.

Many customers remain confused about claim reimbursements due to the intricate nature of auto body insurance coverage and varying reimbursement policies. This article has explored the key areas contributing to this confusion, from understanding complex policy terms to navigating the claims process effectively. By tackling these points head-on, insurance providers can foster greater clarity for customers, enhancing satisfaction and trust in their services. Simplifying communication and streamlining procedures will not only benefit consumers but also lead to more efficient claim settlements, ultimately revolutionizing the industry’s approach to customer service.